Understanding Our Pricing and Service Timelines

At Michelle M Brewster Bookkeeping and Taxes, we recognize that cost is an important factor for our clients. That's why we've compiled a comprehensive guide to help you understand our competitive pricing structure and the efficiency of our services. Our clients often express curiosity about how our rates compare within the industry and the promptness with which we address their financial needs.

Fair Pricing for Every Service

Transparent Billing Practices

We offer straightforward pricing for all our bookkeeping and tax services, ensuring there are no hidden fees. Whether you need simple bookkeeping support or in-depth tax consultation, we provide a clear outline of costs upfront. This transparency allows our clients to budget effectively for their financial needs.

Service Turnaround That You Can Count On

Swift and Efficient Solutions

Timeliness is key in our industry, especially during tax season. Our team at Michelle M Brewster Bookkeeping and Taxes prides itself on quick response times. Typically, clients can expect to receive initial replies to their inquiries within 24 hours. Moreover, we strive for efficient project completion, typically delivering results ahead of deadlines.

Frequently Asked Cost Questions

Addressing Client Concerns

Clients frequently inquire about the cost of our services. The actual price can vary based on the scope and complexity of the services required. To give you a rough estimate, we encourage potential clients to reach out directly, as we can tailor our services to fit various budgets.

Customer Support on Pricing Queries

We’re Here to Help

Understanding pricing for bookkeeping and tax services can be challenging. That's why we are dedicated to providing personalized consultations to discuss your specific needs and explain our pricing structure in detail. Our commitment to client support ensures you never feel lost when it comes to understanding your financial options.

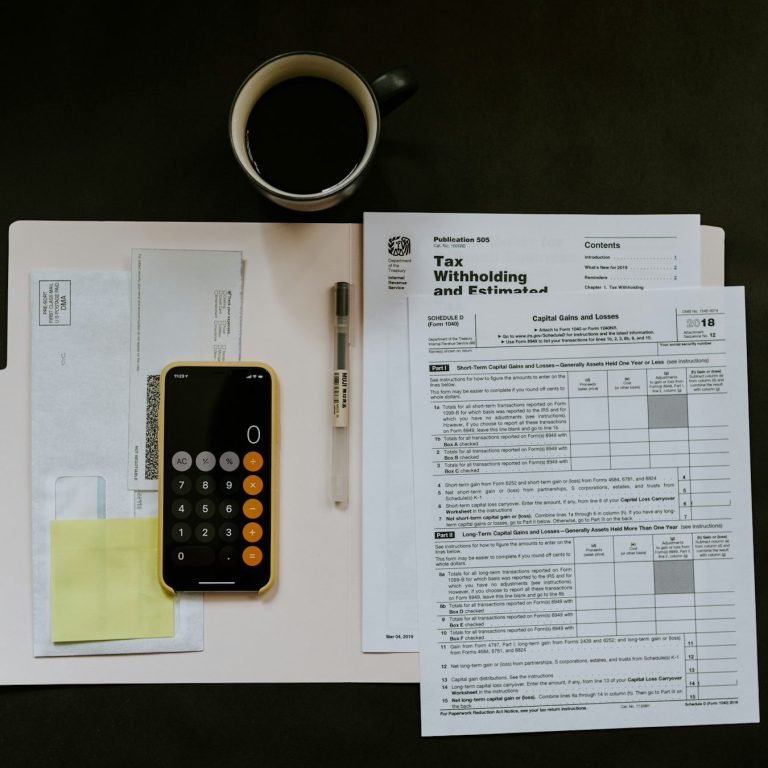

Fast & Reliable Service Turnaround Times

At Michelle M Brewster Bookkeeping and Taxes, we understand that time is money. That’s why we prioritize efficiency in every service we offer. On this page, you’ll find answers to frequently asked questions about our service fees and the average turnaround times for various tax-related services we provide. Having a clear understanding of these details will help you plan your finances strategically and set realistic expectations. Your trust is paramount to us, and we are here to ensure a smooth process from start to finish.

Bookkeeping Services: Processing Times

Our bookkeeping services are designed to keep your financial records organized and accurate. We typically process monthly bookkeeping within 5-7 business days after receiving all necessary documentation. For those who need ongoing assistance, we offer real-time updates and prompt feedback to keep your finances on track.

Tax Preparation: What to Expect

When it comes to tax preparation, our team is committed to providing a thorough and timely service. Expect your tax returns to be prepared within 10-14 business days during peak tax season. This timeline may vary depending on the complexity of your financial situation and the accuracy of the documents provided, so we recommend being as organized as possible.

Consultation Services: Quick Responses

For our tax consultation services, we understand that timely advice is crucial. We aim to schedule your initial consultation within 3-5 business days. After our meeting, you can expect a follow-up with any necessary recommendations or documentation within one week, ensuring you have the guidance you need when you need it.

Additional Services: Personalized Timelines

If you require additional services such as financial planning or business consulting, timelines will be personalized based on your specific needs. Our aim is to provide a tailored approach, ensuring you receive outstanding service without unnecessary delays. We’ll keep you informed every step of the way.

Understanding Our Pricing Structure

At Michelle M Brewster Bookkeeping and Taxes, we believe that financial clarity begins with transparent pricing. Our dedicated team works diligently to offer you tailored bookkeeping and tax solutions that meet your specific needs. Our pricing model is designed to be straightforward, allowing you to understand exactly what you are paying for and why.

Comprehensive Bookkeeping Services

Affordable and Transparent Options

We provide a range of bookkeeping services, from daily transaction recording to monthly financial statements. Each service has a clear pricing structure based on complexity and the level of detail you require, ensuring you never pay for more than you need.

Expert Tax Preparation

Pay Only for What You Need

Navigating taxes can be overwhelming, but our pricing is straightforward. We charge based on the specific services you select, be it individual tax returns, business tax filings, or consultations, ensuring that our fees align with the services rendered.

Tailored Accounting Solutions

Custom Packages to Fit Your Needs

Our accounting services are designed to cater to businesses of all sizes. We offer customizable packages that let you choose the services you need, allowing you to control costs while still receiving expert support.

Personalized Tax Consulting

Make Informed Decisions with Clear Pricing

Our tax consulting services are created to help you make informed decisions about your finances. With a clear list of services and costs upfront, you’ll know what to expect and can plan your budget effectively.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.